We use cookies to offer you a better experience. For more information on how we use cookies you can read our Cookie and Privacy Policy.

What is an NFT and How to Invest in One

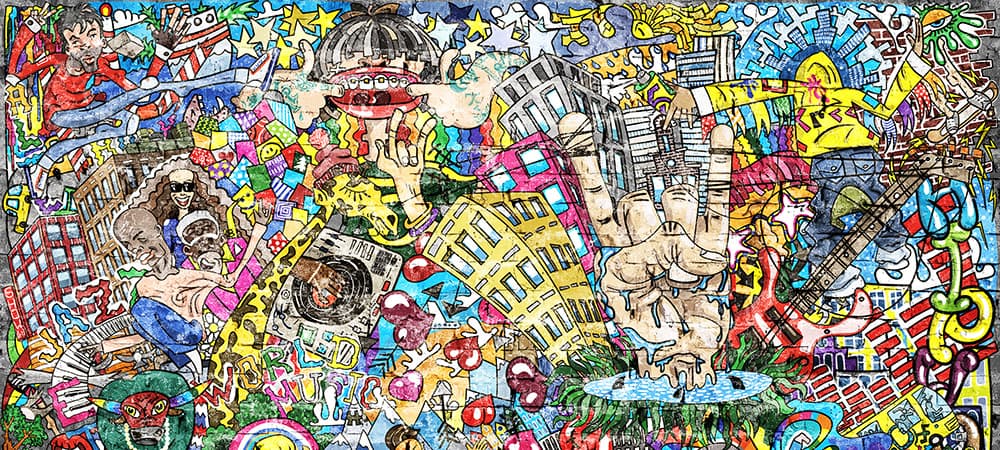

What happens when an artist captures 5,000 digital images and stitches them together into a crypto-backed piece of artwork? In the case of Everydays: the First 5000 Days, an NFT sold earlier this year, they break sales records.

This NFT is both the most expensive NFT sold to date and the most expensive piece of art from a living artist. It commanded millions of dollars at one of the top auction houses, while a Nyan Cat NFT, based on the popular internet meme, fetched $500,000.

In this article, you’ll learn why this new investing option became so newsworthy with helpful information to help you consider if NFTs are something you want to add to your own portfolio.

What is an NFT?

NFT stands for "non-fungible token," which is a digital asset that you can buy and sell on its own value. These assets are limited in number and may command a higher price than a traditional digital asset.

NFT coins, or tokens, can represent a separate good or service, such as an NFT for a year’s worth of noodles from the local ramen shop. Often, it’s its own reward, such as a collection of exciting NBA Top Shot video clips or a sound recording of a private concert.

HOW NFTS DIFFER FROM OTHER DIGITAL ART

Unlike a standard recording or digital art file, NFTs are generally encoded with the same type of software encryption as cryptocurrencies. This unique digital code prevents duplication or outright theft.

WHERE DID NFTS COME FROM?

NFTs have been around since before 2020, but they really caught on early that year. People were looking for new ways to spend their cryptocurrency, particularly during the COVID-19 pandemic lockdowns. Many of the more notable NFTs were created as a way to ward off boredom during that year – and perhaps earn a little money, too.

FUNGIBLE VS NON-FUNGIBLE

A fungible good has a standardized measurement of its worth, with each unit of no particular uniqueness. One U.S. dollar bill is worth the same as another single U.S. dollar bill, for example.

Even Bitcoin and other cryptocurrencies are fungible. You can trade 1 Bitcoin for another of the exact same value. There is no difference between each Bitcoin, and we don’t recognize each as special, unique, or creating value in its individuality.

NFTs, however, have their own unique marker – a digital signature – and cannot be replaced with one another. Each is uniquely different from other NFT types, and digital assets sold as NFTs may not even have the same value within a series. For example, if an artist sells 50 copies of a digital painting, all the same, but with different signatures, each may command a different price.

How NFTs relate to Bitcoin

The NFT-crypto connection is based more on interest than each as an individual item. The NFT market gained popularity among the same crowd that embraced Bitcoin, and many of the first NFTs were only purchasable with cryptocurrency. But how else are they connected?

Many NFTs are built on the same blockchain technology that gives Bitcoin its value. These uniquely coded digital assets utilize this tech so they can claim to be the only one of their kind in existence. The Blockchain tech essentially secures it and preserves its value against someone who may try to copy it.

What are the benefits of NFTs?

The conversation around NFTs has mostly centred on their artistic potential. As it stands now, there’s no easy way for an artist, author, or musician to create a digital file of their work and keep it from being copied over and over. NFTs also make it easier for creators to sell items directly to their fans without the need for a third-party publisher or management company.

For consumers, it removes the difficulty of maintaining the value of digital items. Buying an ebook NFT from an author gives you ownership of that ebook. You can resell it and get the full value, or possibly even more, depending on the worth at the time of sale.

Because NFT digital art is usually created in limited numbers, it’s possible for the items to maintain or even increase in value over time. This is what makes them exciting to those looking for alternative investments to stocks, bonds, and real estate.

What are the risks associated with NFTs?

Any investment, from property and gold to fiat currencies and stocks, is risky. It stands to reason that something so new and unproven as an NFT is also risky. To get a better idea of the risk, however, you only have to look at cryptocurrency’s wild ride to see its share of ups and downs in the market.

There’s another catch you should consider before you place money on an NFT. Are you the type of person who wants to keep up with NFTs and the technology needed to access the value of your tokens? The stories of investors who lost their cryptocurrency, either due to negligence or fraud, are real. If you feel unsure about any aspect of NFTs, it may not be the right investment for you.

How to invest in NFTs

Are you looking to get started in this unique investment vehicle? It’s not as simple as buying NFT stock or opening up a new savings account.

Kyle Kroeger of The Impact Investor has been investing in NFTs since early 2020 and got his start buying lesser-known art and digital files. At first, he approached the concept as a way to build a collection of unique graphics for his digital media portfolio. Then, as more well-known artists and musicians came into the fold, he grew to appreciate the investing potential. He began to invest more into well-known NFTs from respected artists in the digital asset space.

Kyle has advice for those who want to get into NFTs, whether to build a personal collection of beautiful digital assets or to explore the potential long-term monetary investment potential.

“First, you'll definitely need to understand how the blockchain works,” he says. “Second, you need to research the value of completely custom graphic design and artwork such as how each of these digital assets is being made.”

Kyle recommends you ask the following questions before buying an NFT:

- Is it just a copy of a current work?

- Is it rendered through advanced computing?

- What is the value of the digital asset to you, personally?

- Will it be used practically? Or is it pure speculation for profit?

Understanding your motivation for buying can help you prioritize the best NFT tokens for your needs and move ahead with a plan.

Steps to get started with NFTs

1. OPEN A DIGITAL WALLET

The place to start is getting a digital wallet to store digital assets. They’re the same as those you would use to store cryptocurrencies. You may have to buy some crypto to open your wallet and perhaps even use it for your first NFT purchase. Not all NFTs accept traditional payment, though you can typically buy crypto using a credit card or your PayPal account.

2. WHERE CAN YOU BUY NFTS?

OpenSeas.io and Foundation are two popular sites for buying NFTs, but more are popping up all the time. Do your research to see who else is buying and where. Reputable sites often work with big names.

3. ARE YOU LOOKING TO MAKE NFT TOKENS INSTEAD OF BUYING THEM?

If you’re interested in learning how to create NFT art, you can watch what the creators are doing on both of these sites as well, and follow their lead. Foundation even has a creator page to help you get started.

4. WATCH OUT FOR FEES

There are typically fees associated with buying cryptocurrency, and that extends to buying NFTs. Tack on these fees to the sale price so you know the full cost of your investment before you make a purchase.

The future of NFTs is uncertain – but unique

There is a wide range of views on how NFTs will work in the larger overall economy. As news coverage increases, there will be more acceptance for these digital tokens, but that comes with some risk of fraud, abuse, and exploitation.

Unlike Bitcoin and other cryptocurrencies, NFTs could hold intrinsic value far behind their ability to be traded for other items. There is also the matter of owning a limited-number digital art piece outright, and the implications for intellectual property (IP) rights will be fascinating to watch.

Here’s what Kyle says about the future of NFTs:

“The long-term perspective can be very appealing for NFTs. Could a popular NFT's illustration rights eventually become a computer-generated movie? Could it become a character in a book? Outright owning an asset opens the door to a variety of use cases.”

While not as mainstream as real estate or other investment opportunities, the NFT marketplace is likely here to stay. Learning how they work could be a benefit to innovative investors.